The Inflation Reduction Act of 2022 is the largest ever commitment made by the United States to fight climate change, in the form of almost $400 billion in tax incentives aimed at reducing carbon emissions and accelerating the country’s energy transition away from fossil fuels.

While companies associated with renewable energy will likely be the largest and most direct beneficiaries of the act’s incentives, companies in the fossil fuel sector also stand to benefit from several new and expanded incentives designed to cause a redeployment of capital toward decarbonization activities. Utilities will benefit from relaxation of normalization requirements for battery storage.

In many ways, the act, which was signed by President Joe Biden on August 16, 2022, is a rebranding of the Build Back Better Act (BBBA), which passed in the House in 2021 before stalling in the Senate. The Inflation Reduction Act, however, differs in some key respects from BBBA.

Synopsis of Inflation Reduction Act’s Clean Energy Changes

Like the BBBA, the Inflation Reduction Act generally extends existing incentives for clean energy at least at their highest rate. For example, the rate is $27.50 per megawatt hour (MWh) for the production tax credit (PTC) for projects placed in service in 2022, which is up from $26 per MWh pre-Inflation Reduction Act, and 30% of qualifying capital expenditure for the investment tax credit (ITC).

The act also expands the scope and value of existing incentives and adds new ones that fossil fuel companies may find attractive.

Following are some notable changes from previous law and differences from proposals in the BBBA. You can also explore an overview of the tax implications in the act.

Notable Changes from Previous Law

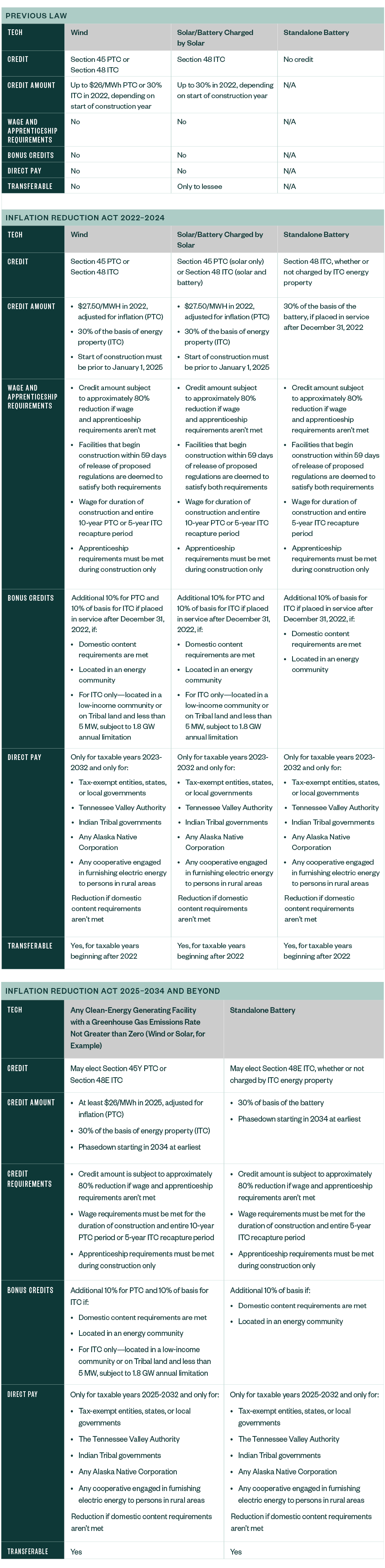

PTC and ITC

- Availability. Full PTCs and ITCs are available for all projects placed in service after 2021 and prior to 2025. The PTC is also now available for solar projects that begin construction prior to 2025. This could be more beneficial than the ITC for many projects. Likewise, the ITC is now available for wind projects.

- Standalone battery storage. If placed in service after December 31, 2022, standalone battery storage qualifies for the ITC, regardless of whether it’s charged by a renewable source.

- New opportunities. There are new PTCs for hydrogen and nuclear, as well as for the domestic manufacturing of components for wind and solar facilities.

New Technology-Neutral Tax Credit

A new technology-neutral tax credit applies to projects placed in service in 2025 or later at the same rates, subject to a phasedown that starts in 2034 at the earliest. This effectively allows taxpayers to choose the PTC or the ITC for all clean power technologies, which was a proposal that was originally in the House-approved version of the BBBA.

Wage and Apprenticeship Requirements

The credits noted above are available at their full rates if specific wage and apprenticeship requirements are met. Otherwise, the credit amount is 20% of the full credit. These requirements apply to projects greater than one megawatt that begin construction more than 59 days after the Treasury Department publishes guidance on the requirements.

For purposes of this article, it’s assumed that most taxpayers will find it economical to meet the wage and apprenticeship requirements rather than reduce their credit amount by 80%; as a result, this article uses the full credit amount throughout. That being said, developers may consider starting construction before guidance is issued, to avoid having to comply with these requirements.

In short, workers must be paid prevailing wages at the rates published for Davis-Bacon Act purposes both during construction and for repairs during the credit period (10 years for the PTC and 5 years for the ITC); and a certain percentage of workers must be qualified apprentices during construction.

Bonus Credits

Bonus credits are available if projects are located in energy communities or meet domestic content requirements. Some projects may qualify for additional bonus credits if located in a low-income area. Bonus credits equal to 10% of basis for the ITC and 10% of the PTC amount are available for projects placed in service after December 31, 2022. These bonus credits are stackable; the total amount of ITC for a solar project may equal 50% or more, for example.

Carbon Capture and Sequestration (CCS).

Increased credits are available for qualified CCS.

Notable Differences Compared with BBBA

- Standalone transmission doesn’t qualify for the ITC.

- The ITC for battery storage is exempt from public utility normalization requirements.

- The ITC on solar remains subject to normalization, but that’s mitigated through the new option to elect the PTC on solar.

- Unrestricted direct pay or refundability of credits is available only for the Internal Revenue Code (IRC) Section 45Q carbon capture and sequestration credit, Section 45V clean hydrogen PTC, Section 45X advanced manufacturing PTC, and Section 48C advanced energy project ITC. Direct pay may be available to certain tax-exempt and governmental entities for other credits.

- Most energy credits covered by the Inflation Reduction Act can be sold for cash to an unrelated party on a one-time basis when the credit is earned.

Detailed List of Tax Credits and Incentives

To help navigate the many new and expanded credits and incentives that are included in the Inflation Reduction Act, you’ll find links to each section below.

Renewable Energy Generation Tax Credits

- Section 45 production tax credit

- Section 48 investment tax credit

- NEW: Section 45Y technology-neutral production tax credit

- NEW: Section 48E technology-neutral investment tax credit

- NEW: Section 45U zero-emission nuclear production tax credit

Carbon Sequestration Tax Credits

Clean Fuels Tax Credits

Clean Vehicles Tax Credits

- Section 30C alternative fuel refueling property tax credit

- NEW: Section 45W qualified commercial clean vehicles tax credit

Energy Manufacturing Tax Credits

- Section 48C advanced energy project tax credit

- NEW: Section 45X advanced manufacturing production tax credit

Energy Efficiency Tax Deduction

Renewable Energy Generation Tax Credits

The following energy generation tax credits are new, expanded, or extended as part of the Inflation Reduction Act:

- Section 45 production tax credit

- Section 48 investment tax credit

- NEW: Section 45Y technology-neutral production tax credit

- NEW: Section 48E technology-neutral investment tax credit

- NEW: Section 45U zero-emission nuclear production tax credit

Section 45 Production Tax Credit (PTC)

Previous Law

Under the previous law, the PTC provided a tax credit for electricity produced from certain renewable resources and sold to unrelated parties for the 10-year period after the property was placed in service. The credit started to phase down for projects that began construction in 2017 and was completely phased out for projects that began construction after December 31, 2021.

The renewable resources that qualify for the PTC generally include wind, biomass, geothermal, hydropower, municipal solid waste, and marine and hydrokinetic energy.

What’s Changed

The Inflation Reduction Act extends the PTC for facilities that begin construction by the end of 2024. The provision provides a credit of $27.50 per MWh, adjusted for inflation and subject to certain wage and apprenticeship requirements.

For projects placed in service after December 31, 2022, if a facility either meets the domestic content requirements or is placed in service in an energy community, the PTC is increased by 10%; if both conditions are satisfied, then the credit is increased by 20% (to $33 per MWh). To meet the domestic content requirement, taxpayers must ensure that specified percentages of certain components are manufactured in the United States. An energy community includes the following:

- Brownfield sites

- Metropolitan or non-metropolitan area with direct employment or local tax revenue over an established percentage related to the extraction, processing, transport, or storage of coal, oil, or natural gas as well as an unemployment rate at or above the national average

- Census tract or any adjoining tract in which a coal mine closed after December 31, 1999, or a coal fired electric power plant was retired after December 31, 2009

For wind facilities, the act eliminates the previous law reduction and phaseout of the PTC rate for facilities placed in service after December 31, 2021.

That means these facilities may now be eligible to receive PTCs at full value. The previous half-credit reduction law for hydropower and marine hydrokinetic facilities was also eliminated.

Significantly, the act also reinstates the PTC for solar energy facilities in which construction begins by the end of 2024.

Post-2024, the act provides for emissions-based, technology-neutral PTCs (described below).

Section 48 Investment Tax Credit (ITC)

The ITC allows taxpayers to claim a credit based on the cost of energy property. The Inflation Reduction Act generally extends the credit for property with construction beginning by the end of 2024.

Under the act, the ITC is expanded to include energy storage technology, including batteries. Energy property also includes costs for interconnection property in connection with the installation of energy property with a maximum net output of less than five mega-watt alternating current (MWac).

In general, for energy property placed in service by the end of 2024, the act restores the credit to 30% of the cost basis, subject to specific wage and apprenticeship requirements.

Energy property placed in service beginning in 2023 that satisfies the domestic content requirements is eligible for a 10 percentage point bonus credit, meaning the credit increases from 30% of cost basis to 40% of cost basis.

Energy property placed in service within an energy community may also be eligible for a 10 percentage point bonus credit.

Solar and wind facilities (and connected batteries) less than five MWac placed in service in 2023 and 2024 may qualify for an additional 10 percentage point bonus credit if located in a low-income neighborhood or on Tribal lands. The bonus credit is subject to an annual capacity limitation of 1.8 gigawatts.

Utilities can elect out of the ITC normalization requirements on battery storage, provided that such election isn’t prohibited by any state or regulatory authority.

Post-2024, the act provides for emissions-based, technology-neutral ITCs.

NEW: Sections 45Y and 48E Technology-Neutral Production Tax Credit and Investment Tax Credit

Post-2024, the Inflation Reduction Act includes incentives for clean electricity production and investment, under an emissions-based framework that’s neutral and flexible between clean energy technologies.

Taxpayers may choose either the PTC under Section 45Y or the ITC under Section 48E, and power facility of any technology type may qualify for the credits if the facility’s carbon emissions are at or below zero.

Taxpayers who satisfy the wage and apprenticeship requirements may be eligible for a PTC of at least $26 per MWh of electricity generated or an ITC equal to 30% of the basis of energy property.

Standalone energy storage property is also eligible for the full 30% ITC, and clean energy projects smaller than five MWac may include the cost of interconnection equipment in the base for determining the ITC.

Again, certain projects may receive 10% increases to their PTC and ITC rates if they comply with domestic content requirements or are constructed in energy communities. An additional 10% increase in ITC also applies for small projects in low-income communities or Tribal lands, subject to the same 1.8 gigawatt annual capacity limitation.

Under the act, these credits begin to phase out for projects that start construction after 2033 or after certain emissions targets are achieved—when the electric power sector emits 75% less carbon than 2022 levels. At this point, the credits will phase out over three years. Stated differently, the earliest the credits would begin to phase out is 2034.

NEW: Section 45U Zero-Emission Nuclear Production Tax Credit

The Inflation Reduction Act creates a new tax credit, known as the nuclear production tax credit, or the nuclear PTC, for qualifying zero-emission nuclear power produced and sold after December 31, 2023. This proposal is generally consistent with the previous nuclear PTC proposal included in the BBBA.

Qualified nuclear power facilities are taxpayer-owned facilities that use nuclear power to generate electricity that:

- Didn’t receive an advanced nuclear PTC allocation under Section 45J

- Are placed in service before the date of enactment (in essence, are existing nuclear power plants)

The base nuclear PTC amount is 1.5 cents per kilowatt-hour (kWh), subject to wage and apprenticeship requirements. It will phase down as average annual electricity prices exceed 2.5 cents per kWh. These amounts would be adjusted for inflation.

The nuclear PTC terminates on December 31, 2032.

Overview for Certain Renewable Energy Generation Tax Credits

Carbon Sequestration Tax Credits

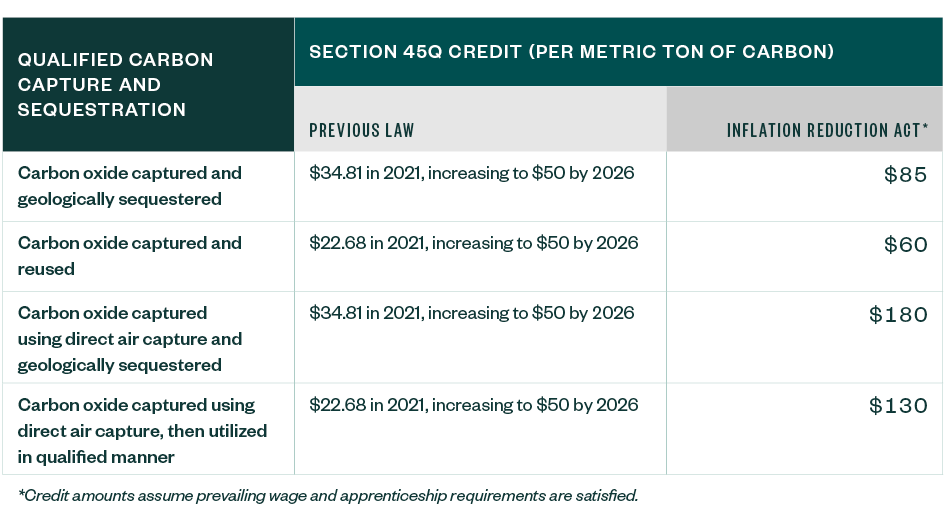

Section 45Q Carbon Capture and Sequestration (CCS) Tax Credit

Previous Law

Under previous law, industrial carbon capture or direct air capture facilities that begin construction by December 31, 2025, can qualify for the Section 45Q tax credit. A facility is only qualified for this purpose if it achieves certain minimum annual capture requirements, and these requirements vary by type of CCS facility.

Assuming all other requirements are satisfied, the amount of Section 45Q tax credit is computed per metric ton of qualified carbon oxide captured and sequestered. It can be claimed for carbon oxide captured during the 12-year period beginning on the date a qualified facility was originally placed in service.

What’s Changed

The Inflation Reduction Act extends the start of construction deadline to December 31, 2032, and substantially lowers the minimum annual capture requirements for qualifying facilities placed in service prior to January 1, 2023, while increasing the potential credit amount.

The Section 45Q tax credit is computed per metric ton of qualified carbon oxide captured and sequestered, and the full credit below is also conditioned on meeting the wage and apprenticeship requirements.

A facility is only qualified for this credit if it achieves certain minimum annual capture requirements, which vary by type of CCS facility.

Credit Amounts per Metric Ton of Carbon Captured

Clean Fuels Tax Credits

The following clean fuel credits are new, expanded, or extended as part of the Inflation Reduction Act:

- NEW: Section 45V clean hydrogen production tax credit

- NEW: Section 40B sustainable aviation fuel credit

- Biodiesel renewable fuels and alternative fuels

- Section 45Z clean fuel production credit

NEW: Section 45V Clean Hydrogen Production Tax Credit

The Inflation Reduction Act creates a new tax credit for the qualified production of clean hydrogen, known as the clean hydrogen PTC. The new law is generally consistent with the previous proposal included in the BBBA.

The clean hydrogen PTC provides a tax credit of up to $3 per kilogram (kg) based on the life-cycle greenhouse gas emissions rate of CO2 produced at a qualifying facility during the facility’s first 10 years of operation. This is subject again to the wage and apprenticeship requirements, which if not met reduce the credit by 80%.

To qualify for the clean hydrogen PTC, new facilities must begin construction before January 1, 2033. Facilities existing before January 1, 2023, may qualify based on the date that modifications to the facility required to produce clean hydrogen are placed into service. The hydrogen also must be produced through a process resulting in lifetime greenhouse gas emissions of no more than four kgs of C02e per kg of hydrogen.

If a taxpayer uses electricity produced from renewable resources to power a qualified clean hydrogen production facility, that taxpayer may be able to claim the clean hydrogen PTC in addition to tax credits on the renewable energy generation; however, a clean hydrogen PTC may not be claimed in conjunction with a Section 45Q tax credit.

A taxpayer may elect to claim the ITC in lieu of the clean hydrogen PTC.

Other Key Clean Fuel Proposals

NEW: Section 40B Sustainable Aviation Fuel Tax Credit

The Inflation Reduction Act adds a new tax credit for the sale or mixture of sustainable aviation fuel that is only available during 2023 and 2024.

Biodiesel, Renewable Fuels, and Alternative Fuels

The act extends the biodiesel, renewable diesel, alternative fuels, alternative fuels mixtures and second-generation fuels tax credits through December 31, 2024.

Section 45Z Clean Fuel Production Tax Credit

Starting after December 31, 2024, the sustainable aviation fuel, biodiesel renewable fuels, and alternative fuels credits will transition to the clean fuel production credit, which terminates on December 31, 2027.

Clean Vehicles Tax Credits

The following clean vehicle credits for businesses are new, expanded, or extended as part of the Inflation Reduction Act:

- Section 30C alternative fuel refueling property credit

- NEW: Section 45W qualified commercial clean vehicles credit

Section 30C Alternative Fuel Refueling Property Tax Credit

Previous Law

Under the previous law, Section 30C allows a tax credit in an amount equal to 30% of the cost of any qualified alternative fuel vehicle refueling property—an electric vehicle charging station, for example—placed in service before January 1, 2022.

What’s Changed

Section 30C(b) limits the maximum credit allowable with respect to all qualified alternative fuel vehicle refueling property at a location to $100,000 for businesses.

For this purpose, only the following are treated as qualified alternative fuel:

- Any fuel at least 85% of the volume of which consists of one or more of the following:

- Ethanol

- Natural gas

- Compressed natural gas

- Liquefied natural gas

- Liquefied petroleum gas

- Hydrogen

- Any mixture that consists of two or more of the following:

- Biodiesel (at least 20% of the volume must consist of biodiesel determined without regard to any kerosene in the mixture.)

- Diesel fuel

- Kerosene

The Inflation Reduction Act extends the alternative fuel refueling property credit for qualifying property placed in service before January 1, 2033.

However, beginning after December 31, 2022, only property placed in service within a low-income or rural census tract area is considered a qualified property. The definition of qualifying property for this purpose now includes bidirectional charging equipment.

Assuming all other requirements are satisfied, the alternative fuel refueling property credit is at a maximum rate of 30% of cost basis if prevailing wage and registered apprenticeship requirements are met.

NEW: Section 45W Qualified Commercial Clean Vehicles Tax Credit

The Inflation Reduction Act creates a new tax credit for qualified commercial clean vehicles, equal to the lesser of:

- 15% of the vehicle’s cost (30% for vehicles not powered by a gasoline or diesel internal combustion engine)

- The incremental (excess) cost of the vehicle relative to a comparable vehicle

Credit amounts can’t exceed $7,500 for vehicles weighing less than 14,000 pounds, or $40,000 otherwise.

Eligible vehicles would have a battery capacity of not less than 15 kilowatt hours (seven kilowatt hours in the case of vehicles weighing less than 14,000 pounds) and be charged by an external source of electricity. Mobile machinery and qualified commercial fuel cell vehicles would also be eligible for this credit. Qualifying vehicles must be depreciable property.

Only vehicles made by qualified manufacturers that have written agreements with and provide periodic reports to the Treasury could qualify. Taxpayers are required to include the vehicle identification number (VIN) on their tax return to claim a tax credit.

The credit applies to any vehicles placed in service after December 31, 2022, and before January 1, 2033.

Energy Manufacturing Tax Credits

The following energy manufacturing credits are new, expanded, or extended as part of the Inflation Reduction Act:

- Section 48C advanced energy project credit

- NEW: Section 45X advanced manufacturing production tax credit

Section 48C Advanced Energy Project Tax Credit

Previous Law

Under previous law, Section 48C allows a tax credit in an amount equal to 30% of a taxpayer’s qualified investment with respect to any qualified advanced energy project of the taxpayer.

The term qualifying advanced energy project is defined as a project that re-equips, expands, or establishes a manufacturing facility for the production of various types of renewable or clean energy—solar, wind, and CCS, for example.

What’s Changed

The Inflation Reduction Act provides a maximum allocation of $10 billion with respect to the advanced energy project credit and expands the definition to include a wide range of renewable energy equipment.

The 30% credit rate is allowed for projects meeting prevailing wage and apprenticeship requirements, with an 80% credit reduction if those requirements aren’t met.

The Secretary of the Treasury will establish a program to award credits to qualifying advanced energy project sponsors. Applicants accepting certifications for credits have two years to provide evidence that the requirements of the certification have been met and to place property in service.

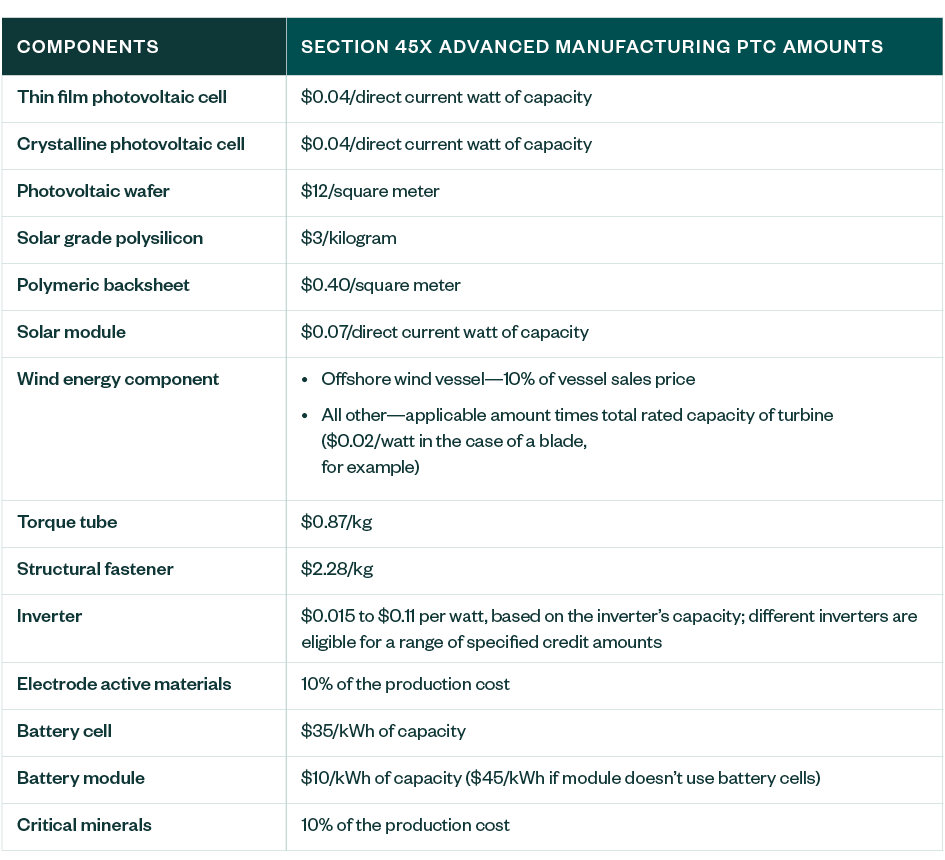

NEW: Section 45X Advanced Manufacturing Production Tax Credit

The Inflation Reduction Act creates a new PTC that could be claimed for the domestic production and sale of qualifying solar, wind and battery components—solar photovoltaic cells, for example.

Note that the advanced manufacturing PTC can’t be claimed for components produced at a facility for which a credit was claimed under Section 48C. The credit amount varies based on the component produced, which is outlined in the below table. Many of the credit amounts mirror those in the BBBA proposals, although some amounts and components differ.

Components Produced with Related Credit Amounts

Energy Efficiency Tax Deduction

Section 179D Energy Efficient Commercial Buildings Tax Deduction

The Inflation Reduction Act dramatically increases the Section 179D energy-efficient commercial building deduction, making it especially impactful for the architecture, engineering, and construction (AEC) industries as well as commercial building owners. They apply to qualifying property placed in service after December 31, 2022.

What’s Changed

- Who’s eligible

- Increases qualification thresholds

- Adds bonus deduction

- Updates American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) standard requirements

- Creates alternate deduction path

With additional value and complexity with changes to Section 179D, it’s important to choose an Section 179D provider who understands the risks, can help mitigate IRS actions, and possesses the technical knowledge to perform compliant Section 179D studies.

We’re Here to Help

To learn more about how provisions in the Inflation Reduction Act of 2022 could impact your business, contact your Moss Adams professional. You can also see the most updated tax planning strategies related to these changes on our Tax Planning Resources page.